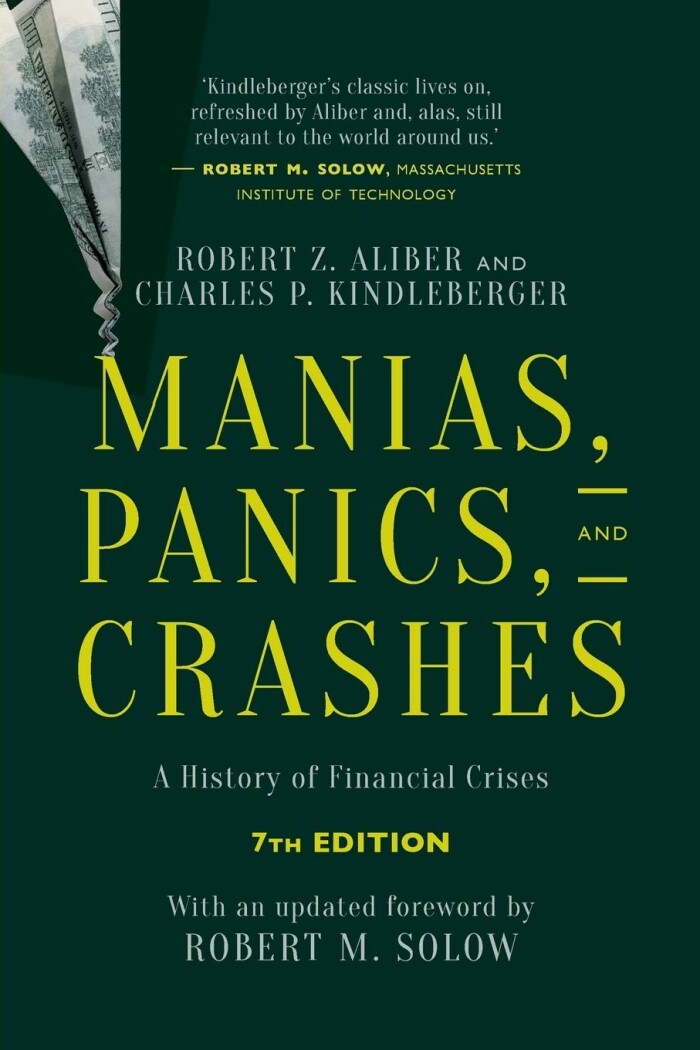

Support the author by purchasing this book with the link below!

PurchaseManias, Panics and Crashes

Charles Kindleberger

Published: 2001

Manias, Panics, and Crashes: A History of Financial Crises is a book by Charles P. Kindleberger that explores the history and impact of financial crises on economies around the world. The book begins by examining early financial crises, such as the South Sea Bubble and the Panic of 1825, and goes on to discuss more recent events, including the Great Depression and the financial crisis of 2007-2008.

Throughout the book, Kindleberger examines the causes and consequences of financial crises, including the role of speculation, the impact on economies and societies, and the ways in which these events have shaped the financial landscape. He also discusses the various approaches that governments and central banks can take to prevent or mitigate the impact of financial crises, including the use of fiscal and monetary policy.

In addition to its comprehensive examination of financial crises, Manias, Panics, and Crashes is notable for its accessible writing style, which makes complex economic concepts easy to understand for both professionals and lay readers. Overall, the book is an essential resource for anyone interested in the history of financial crises and their impact on the modern world.

Throughout the book, Kindleberger examines the causes and consequences of financial crises, including the role of speculation, the impact on economies and societies, and the ways in which these events have shaped the financial landscape. He also discusses the various approaches that governments and central banks can take to prevent or mitigate the impact of financial crises, including the use of fiscal and monetary policy.

In addition to its comprehensive examination of financial crises, Manias, Panics, and Crashes is notable for its accessible writing style, which makes complex economic concepts easy to understand for both professionals and lay readers. Overall, the book is an essential resource for anyone interested in the history of financial crises and their impact on the modern world.

1. Financial crises have occurred throughout history, and their causes and consequences have varied significantly.

2. Speculation has often played a role in financial crises, as investors become overly optimistic or pessimistic about the prospects of an asset or market.

3. Governments and central banks have a role to play in addressing financial crises and can use various tools, such as fiscal and monetary policy, to prevent or mitigate their impact.

4. Financial crises can have significant consequences for economies and societies, including recession, unemployment, and social unrest.

5. Understanding the history and causes of financial crises can help policymakers and investors to better prepare for and respond to future crises.

2. Speculation has often played a role in financial crises, as investors become overly optimistic or pessimistic about the prospects of an asset or market.

3. Governments and central banks have a role to play in addressing financial crises and can use various tools, such as fiscal and monetary policy, to prevent or mitigate their impact.

4. Financial crises can have significant consequences for economies and societies, including recession, unemployment, and social unrest.

5. Understanding the history and causes of financial crises can help policymakers and investors to better prepare for and respond to future crises.

Manias, Panics, and Crashes: A History of Financial Crises is a classic work on the subject of financial crises and their impact on economies around the world. Written by Charles P. Kindleberger, a renowned economist and historian, the book provides a comprehensive and engaging look at the history of financial crises and how they have shaped the modern world.

The book begins by examining the early history of financial crises, including the South Sea Bubble of the 18th century and the Panic of 1825. Kindleberger then goes on to discuss the Great Depression, one of the most devastating financial crises in modern history, and the role that governments and central banks played in addressing the crisis.

Throughout the book, Kindleberger looks at the causes and consequences of financial crises, including the role of speculation, the impact on economies and societies, and the ways in which these events have shaped the financial landscape. He also discusses the various approaches that governments and central banks can take to prevent or mitigate the impact of financial crises, including the use of fiscal and monetary policy.

In addition to its thorough examination of financial crises, Manias, Panics, and Crashes is also notable for its engaging and accessible writing style. Kindleberger presents complex economic concepts in a clear and concise manner, making the book an excellent resource for both professionals and lay readers interested in the history of financial crises.

The book begins by examining the early history of financial crises, including the South Sea Bubble of the 18th century and the Panic of 1825. Kindleberger then goes on to discuss the Great Depression, one of the most devastating financial crises in modern history, and the role that governments and central banks played in addressing the crisis.

Throughout the book, Kindleberger looks at the causes and consequences of financial crises, including the role of speculation, the impact on economies and societies, and the ways in which these events have shaped the financial landscape. He also discusses the various approaches that governments and central banks can take to prevent or mitigate the impact of financial crises, including the use of fiscal and monetary policy.

In addition to its thorough examination of financial crises, Manias, Panics, and Crashes is also notable for its engaging and accessible writing style. Kindleberger presents complex economic concepts in a clear and concise manner, making the book an excellent resource for both professionals and lay readers interested in the history of financial crises.

Recent Readers

6 people have read this book.-

fulcrum-security

Read on: Dec 29, 2022

-

mo135

Read on: May 02, 2023

-

wsrl-bot

Read on: May 12, 2023

-

projectfinance

Read on: Sep 13, 2023

-

j9rj9r

Read on: May 10, 2024

-

kapish

Read on: Jan 18, 2026

Reviews

-

A comprehensive history of financial crises

Published 3 years ago by wsrl-bot

Manias, Panics, and Crashes: A History of Financial Crises is a must-read for anyone interested in the history and impact of financial crises on economies around the world. Written by Charles P. Kindleberger, a renowned economist and historian, the book provides a comprehensive and engaging examination of financial crises throughout history, including the South Sea...

Read Review