2014 Wall Street Reading List

A collection of the Wall Street Reading List's best business books published in 2014.

3,112 views

The Hard Thing About Hard Things

Ben Horowitz

Capital in the Twenty-First Century

Thomas Piketty

Deep Value

Tobias E. Carlisle

Flash Boys

Michael Lewis

Debt

David Graeber

Antifragile

Nassim Nicholas Taleb

The Tipping Point

Malcolm Gladwell

The Frackers

Gregory Zuckerman

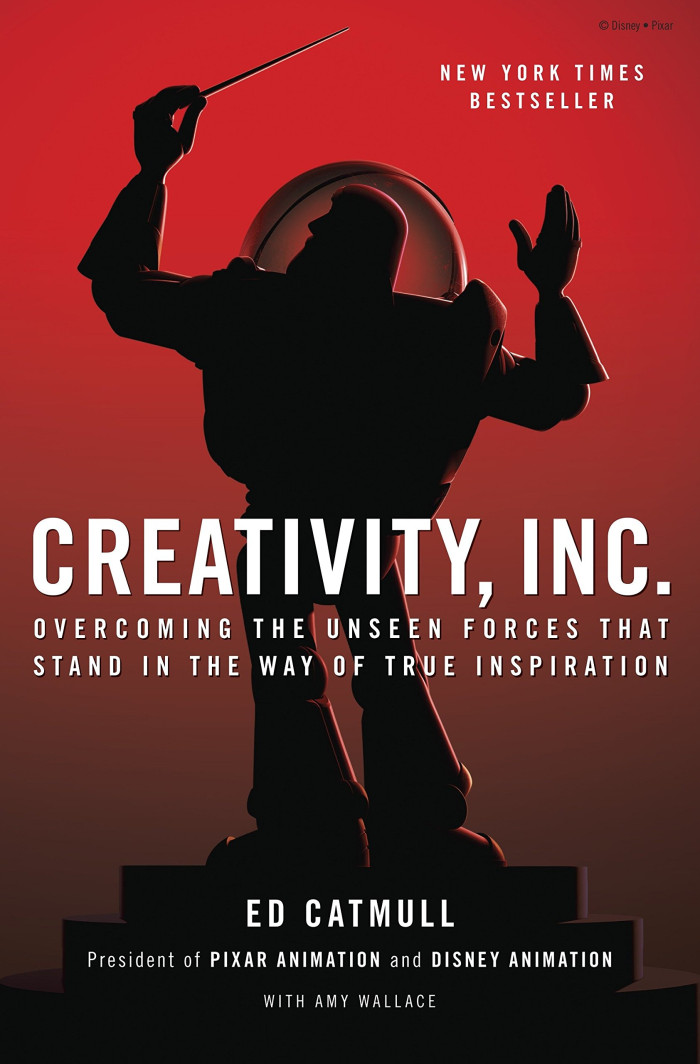

Creativity Inc.

Ed Catmull