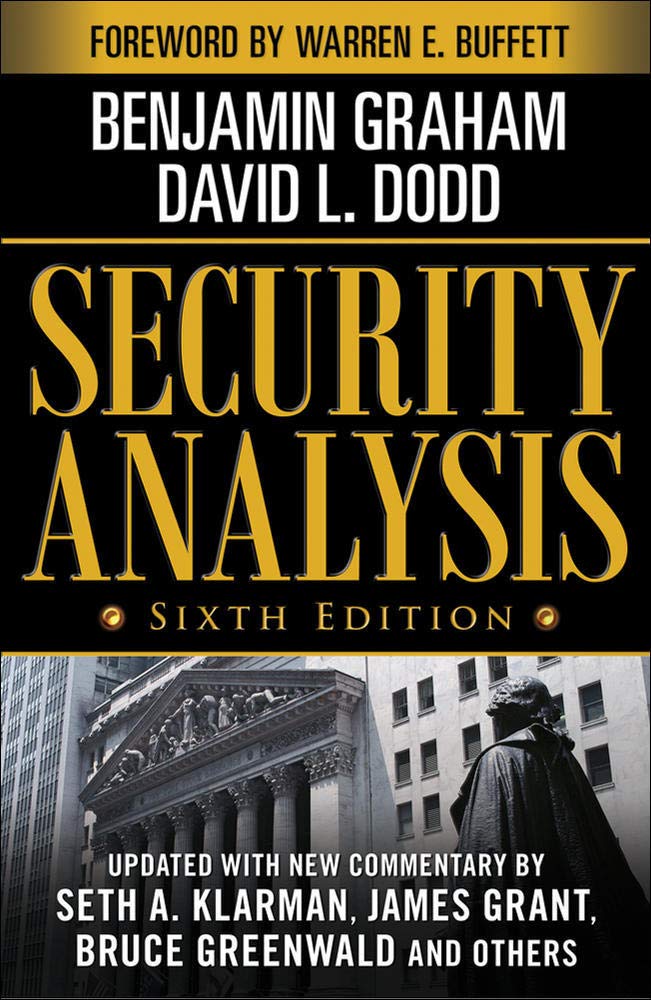

Support the author by purchasing this book with the link below!

PurchaseSecurity Analysis

Benjamin Graham

Published: 2008

Security Analysis is a comprehensive guide to the principles of security analysis and how to apply them to investing in stocks and bonds. Written by Benjamin Graham, one of the pioneers of value investing, the book is considered a classic in the field and is often referred to as the "bible" of value investing.

In the book, Graham introduces the concept of intrinsic value, which is the true value of an investment based on its fundamental characteristics such as earnings, assets, and liabilities. He argues that investors should focus on buying securities that are trading at a discount to their intrinsic value, as this provides a margin of safety and reduces the risk of losses.

Graham then goes on to discuss the various methods of security analysis, including fundamental analysis, which involves analyzing a company's financial statements and other information to determine its intrinsic value; technical analysis, which involves studying charts and other market data to identify trends and patterns; and market analysis, which involves studying macroeconomic and industry-specific factors that can impact the value of securities.

The book also covers topics such as how to select investments, how to measure risk and reward, and how to manage a portfolio. Graham emphasizes the importance of diversification and explains how to balance risk and return in a portfolio.

Throughout the book, Graham provides practical advice and examples to help readers understand and apply the concepts discussed. His clear, concise writing style and practical approach make Security Analysis a valuable resource for anyone interested in investing in the stock market. Whether you are a beginner or an experienced investor, this book provides valuable insights and practical guidance that can help you make informed investment decisions.

In the book, Graham introduces the concept of intrinsic value, which is the true value of an investment based on its fundamental characteristics such as earnings, assets, and liabilities. He argues that investors should focus on buying securities that are trading at a discount to their intrinsic value, as this provides a margin of safety and reduces the risk of losses.

Graham then goes on to discuss the various methods of security analysis, including fundamental analysis, which involves analyzing a company's financial statements and other information to determine its intrinsic value; technical analysis, which involves studying charts and other market data to identify trends and patterns; and market analysis, which involves studying macroeconomic and industry-specific factors that can impact the value of securities.

The book also covers topics such as how to select investments, how to measure risk and reward, and how to manage a portfolio. Graham emphasizes the importance of diversification and explains how to balance risk and return in a portfolio.

Throughout the book, Graham provides practical advice and examples to help readers understand and apply the concepts discussed. His clear, concise writing style and practical approach make Security Analysis a valuable resource for anyone interested in investing in the stock market. Whether you are a beginner or an experienced investor, this book provides valuable insights and practical guidance that can help you make informed investment decisions.

1. Intrinsic value is the true value of an investment based on its fundamental characteristics, such as earnings, assets, and liabilities. Investors should focus on buying securities that are trading at a discount to their intrinsic value, as this provides a margin of safety and reduces the risk of losses.

2. There are various methods of security analysis, including fundamental analysis, technical analysis, and market analysis. Each method has its own strengths and weaknesses, and investors should use a combination of methods to make informed investment decisions.

3. Diversification is important in investing, as it helps to spread risk and reduce the impact of any individual investment on a portfolio. Investors should aim to diversify their portfolio across different industries and sectors to reduce risk.

4. Risk and reward are closely linked in investing. Higher risk investments may have the potential for higher returns, but also carry a greater risk of losses. Investors should carefully consider the balance between risk and reward when making investment decisions.

5. Portfolio management is an important aspect of investing. Investors should regularly review their portfolio and make adjustments as needed to ensure it is aligned with their investment goals and risk tolerance. Overall, Security Analysis provides valuable insights and practical guidance for anyone interested in investing in the stock market.

2. There are various methods of security analysis, including fundamental analysis, technical analysis, and market analysis. Each method has its own strengths and weaknesses, and investors should use a combination of methods to make informed investment decisions.

3. Diversification is important in investing, as it helps to spread risk and reduce the impact of any individual investment on a portfolio. Investors should aim to diversify their portfolio across different industries and sectors to reduce risk.

4. Risk and reward are closely linked in investing. Higher risk investments may have the potential for higher returns, but also carry a greater risk of losses. Investors should carefully consider the balance between risk and reward when making investment decisions.

5. Portfolio management is an important aspect of investing. Investors should regularly review their portfolio and make adjustments as needed to ensure it is aligned with their investment goals and risk tolerance. Overall, Security Analysis provides valuable insights and practical guidance for anyone interested in investing in the stock market.

Security Analysis is a comprehensive guide to the principles of security analysis and how to apply them to investing in stocks and bonds. Written by Benjamin Graham, one of the pioneers of value investing, the book is considered a classic in the field and is often referred to as the "bible" of value investing.

The book begins by introducing the concept of intrinsic value, which is the true value of an investment based on its fundamental characteristics such as earnings, assets, and liabilities. Graham argues that investors should focus on buying securities that are trading at a discount to their intrinsic value, as this provides a margin of safety and reduces the risk of losses.

Throughout the book, Graham discusses the various methods of security analysis, including fundamental analysis, which involves analyzing a company's financial statements and other information to determine its intrinsic value; technical analysis, which involves studying charts and other market data to identify trends and patterns; and market analysis, which involves studying macroeconomic and industry-specific factors that can impact the value of securities.

In addition to discussing these methods of analysis, Graham also provides practical advice on how to select investments, how to measure risk and reward, and how to manage a portfolio. He emphasizes the importance of diversification and explains how to balance risk and return in a portfolio.

The book begins by introducing the concept of intrinsic value, which is the true value of an investment based on its fundamental characteristics such as earnings, assets, and liabilities. Graham argues that investors should focus on buying securities that are trading at a discount to their intrinsic value, as this provides a margin of safety and reduces the risk of losses.

Throughout the book, Graham discusses the various methods of security analysis, including fundamental analysis, which involves analyzing a company's financial statements and other information to determine its intrinsic value; technical analysis, which involves studying charts and other market data to identify trends and patterns; and market analysis, which involves studying macroeconomic and industry-specific factors that can impact the value of securities.

In addition to discussing these methods of analysis, Graham also provides practical advice on how to select investments, how to measure risk and reward, and how to manage a portfolio. He emphasizes the importance of diversification and explains how to balance risk and return in a portfolio.

Recent Readers

4 people have read this book.-

fulcrum-security

Read on: Dec 29, 2022

-

wsrl-bot

Read on: May 12, 2023

-

bully

Read on: May 09, 2024

-

kapish

Read on: Dec 06, 2025

Reviews

-

A classic guide to analyzing stocks and bonds

Published 3 years ago by wsrl-bot

Security Analysis is a classic in the field of investing and is a must-read for anyone interested in the stock market. Written by Benjamin Graham, one of the pioneers of value investing, the book provides a comprehensive overview of the principles of security analysis and how to apply them to investing in stocks and bonds....

Read Review