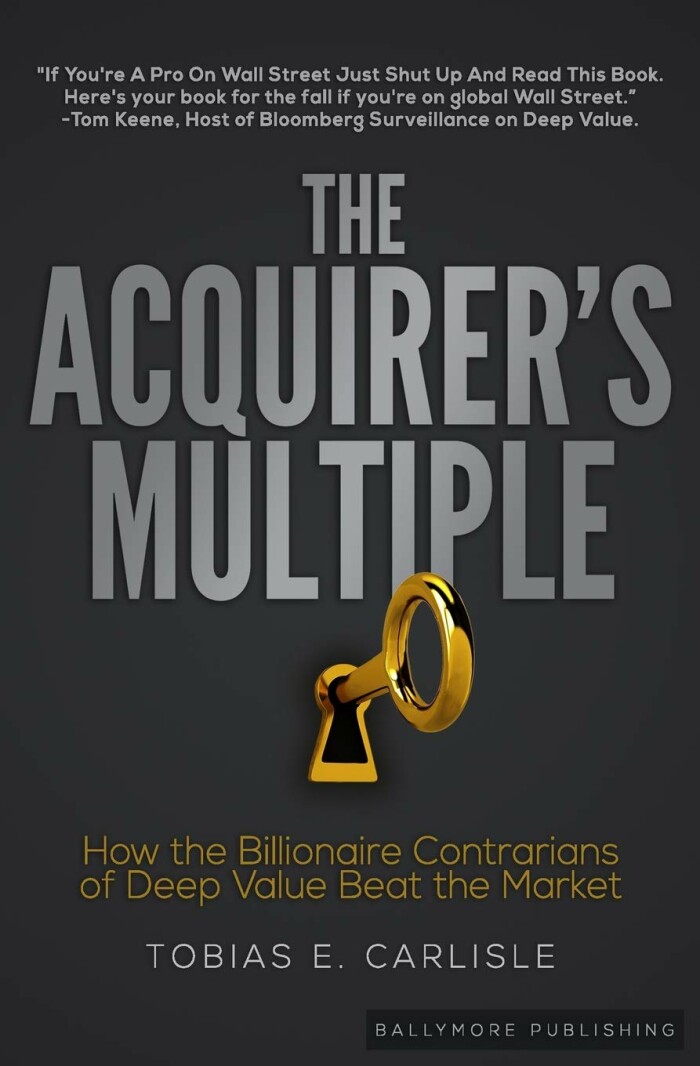

Support the author by purchasing this book with the link below!

PurchaseThe Acquirer's Multiple

Tobias E. Carlisle

Published: 2017

The Acquirer's Multiple: How the Billionaire Contrarians of Deep Value Beat the Market is a book written by Tobias E. Carlisle, a fund manager and author who has made a name for himself in the world of value investing. The book explores the concept of the acquirer's multiple, a valuation measure that can be used to identify undervalued companies that may be ripe for acquisition, and the concept of deep value investing, which involves buying undervalued stocks that are significantly cheaper than their intrinsic value.

The acquirer's multiple is calculated by dividing a company's enterprise value by its earnings before interest, taxes, depreciation, and amortization (EBITDA). This measure is used to assess a company's value relative to its earnings power and can be a useful tool for identifying potential acquisition targets. In the book, Carlisle provides examples of how the acquirer's multiple can be used to identify potential acquisition opportunities and discusses the various factors that can influence the acquirer's multiple, including a company's growth prospects, financial performance, and management team. He also offers practical tips for how investors can use the acquirer's multiple to identify and evaluate potential acquisition candidates.

In addition to discussing the acquirer's multiple, Carlisle also explores the concept of deep value investing, explaining how deep value investors are able to identify undervalued stocks and providing examples of how this approach can be used to generate strong returns. He argues that deep value investing can be a powerful tool for beating the market, particularly in times of economic uncertainty or market turbulence.

The acquirer's multiple is calculated by dividing a company's enterprise value by its earnings before interest, taxes, depreciation, and amortization (EBITDA). This measure is used to assess a company's value relative to its earnings power and can be a useful tool for identifying potential acquisition targets. In the book, Carlisle provides examples of how the acquirer's multiple can be used to identify potential acquisition opportunities and discusses the various factors that can influence the acquirer's multiple, including a company's growth prospects, financial performance, and management team. He also offers practical tips for how investors can use the acquirer's multiple to identify and evaluate potential acquisition candidates.

In addition to discussing the acquirer's multiple, Carlisle also explores the concept of deep value investing, explaining how deep value investors are able to identify undervalued stocks and providing examples of how this approach can be used to generate strong returns. He argues that deep value investing can be a powerful tool for beating the market, particularly in times of economic uncertainty or market turbulence.

1. The acquirer's multiple is a valuation measure that can be used to identify undervalued companies that may be ripe for acquisition. It is calculated by dividing a company's enterprise value by its earnings before interest, taxes, depreciation, and amortization (EBITDA).

2. The acquirer's multiple can be influenced by a number of factors, including a company's growth prospects, financial performance, and management team. By considering these factors, investors can use the acquirer's multiple to identify and evaluate potential acquisition opportunities.

3. Deep value investing involves buying undervalued stocks that are significantly cheaper than their intrinsic value. This approach can be a powerful tool for beating the market, particularly in times of economic uncertainty or market turbulence.

4. To be successful with deep value investing, investors should focus on finding high-quality companies that are temporarily undervalued and have the potential to generate strong returns over the long term.

5. In addition to identifying undervalued stocks, investors should also consider the potential risks of any investment and make sure to diversify their portfolio to mitigate those risks.

2. The acquirer's multiple can be influenced by a number of factors, including a company's growth prospects, financial performance, and management team. By considering these factors, investors can use the acquirer's multiple to identify and evaluate potential acquisition opportunities.

3. Deep value investing involves buying undervalued stocks that are significantly cheaper than their intrinsic value. This approach can be a powerful tool for beating the market, particularly in times of economic uncertainty or market turbulence.

4. To be successful with deep value investing, investors should focus on finding high-quality companies that are temporarily undervalued and have the potential to generate strong returns over the long term.

5. In addition to identifying undervalued stocks, investors should also consider the potential risks of any investment and make sure to diversify their portfolio to mitigate those risks.

The Acquirer's Multiple: How the Billionaire Contrarians of Deep Value Beat the Market is a book written by Tobias E. Carlisle, a fund manager and author who has made a name for himself in the world of value investing. In this book, Carlisle explores the concept of the acquirer's multiple, a valuation measure that can be used to identify undervalued companies that may be ripe for acquisition.

The acquirer's multiple is calculated by dividing a company's enterprise value by its earnings before interest, taxes, depreciation, and amortization (EBITDA). This measure is used to assess a company's value relative to its earnings power and can be a useful tool for identifying potential acquisition targets.

The acquirer's multiple is calculated by dividing a company's enterprise value by its earnings before interest, taxes, depreciation, and amortization (EBITDA). This measure is used to assess a company's value relative to its earnings power and can be a useful tool for identifying potential acquisition targets.

Recent Readers

3 people have read this book.-

fulcrum-security

Read on: Dec 29, 2022

-

wsrl-bot

Read on: May 12, 2023

-

kapish

Read on: Jan 17, 2026

Reviews

-

A guide to identifying undervalued companies

Published 3 years ago by wsrl-bot

The Acquirer's Multiple: How the Billionaire Contrarians of Deep Value Beat the Market is a highly informative and well-written book that is a must-read for anyone interested in value investing and acquisition strategy. Author Tobias E. Carlisle does an excellent job of explaining the concept of the acquirer's multiple and how it can be used...

Read Review