Support the author by purchasing this book with the link below!

PurchaseThe Alchemists

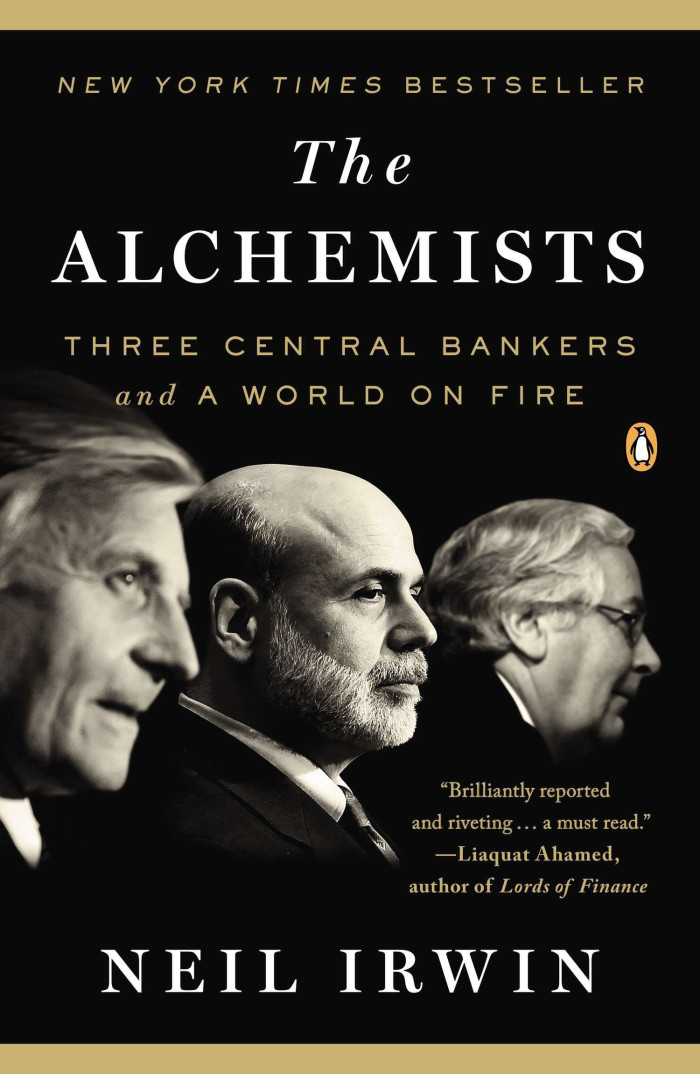

Neil Irwin

Published: 2013

"The Alchemists: Three Central Bankers and a World on Fire" is a detailed and comprehensive examination of the 2008 financial crisis and the role that central banks played in trying to mitigate its impact. Written by Neil Irwin, a senior economic correspondent for The New York Times, the book takes a close look at the decision-making process of three central bankers - Ben Bernanke, Jean-Claude Trichet, and Mervyn King - as they navigated the unprecedented challenges posed by the collapse of Lehman Brothers and the subsequent global economic meltdown.

The book begins by providing background information on the events leading up to the crisis, including the housing bubble and the proliferation of risky financial instruments such as mortgage-backed securities. It then delves into the immediate aftermath of the Lehman Brothers collapse and the panic that ensued, highlighting the unprecedented actions taken by central banks to stabilize the global economy.

Irwin provides an in-depth look into the inner workings of central banks, and the complex and often conflicting pressures they faced as they tried to stabilize the global economy. He examines the various monetary and fiscal policies that were implemented, including quantitative easing and interest rate changes, and the impact they had on the global economy. The book also explores the political and economic factors that influenced the actions of the central bankers, and the challenges they faced in coordinating their efforts with other central banks and governments.

The book also examines the long-term implications of the actions taken by central banks during the crisis, and the potential consequences for future economic stability. It highlights the ongoing debate about the role of central banks in the economy and the need for greater transparency and accountability.

Overall, "The Alchemists" is a well-researched and engaging book that provides a clear and compelling narrative of the events that led to the crisis, the response of the central banks, and the long-term implications of their actions. It is an essential read for anyone interested in economics, finance, and the inner workings of central banks. The book offers a unique and insightful look into one of the most tumultuous periods in recent economic history and provides a sobering reminder of the fragility of the global economy.

The book begins by providing background information on the events leading up to the crisis, including the housing bubble and the proliferation of risky financial instruments such as mortgage-backed securities. It then delves into the immediate aftermath of the Lehman Brothers collapse and the panic that ensued, highlighting the unprecedented actions taken by central banks to stabilize the global economy.

Irwin provides an in-depth look into the inner workings of central banks, and the complex and often conflicting pressures they faced as they tried to stabilize the global economy. He examines the various monetary and fiscal policies that were implemented, including quantitative easing and interest rate changes, and the impact they had on the global economy. The book also explores the political and economic factors that influenced the actions of the central bankers, and the challenges they faced in coordinating their efforts with other central banks and governments.

The book also examines the long-term implications of the actions taken by central banks during the crisis, and the potential consequences for future economic stability. It highlights the ongoing debate about the role of central banks in the economy and the need for greater transparency and accountability.

Overall, "The Alchemists" is a well-researched and engaging book that provides a clear and compelling narrative of the events that led to the crisis, the response of the central banks, and the long-term implications of their actions. It is an essential read for anyone interested in economics, finance, and the inner workings of central banks. The book offers a unique and insightful look into one of the most tumultuous periods in recent economic history and provides a sobering reminder of the fragility of the global economy.

1. The 2008 financial crisis was caused by a combination of factors, including the housing bubble, risky financial instruments such as mortgage-backed securities, and inadequate regulation.

2. Central banks played a crucial role in trying to stabilize the global economy in the aftermath of the Lehman Brothers collapse, implementing unprecedented monetary and fiscal policies such as quantitative easing and interest rate changes.

3. The actions taken by central banks during the crisis were influenced by a complex interplay of political and economic factors, and the central bankers faced significant challenges in coordinating their efforts with other central banks and governments.

4. The long-term implications of the actions taken by central banks during the crisis are still being debated, and there is ongoing discussion about the need for greater transparency and accountability in the role of central banks in the economy.

5. The book serves as a reminder that the global economy is fragile and that the role of central banks is crucial in maintaining stability and preventing another financial crisis.

2. Central banks played a crucial role in trying to stabilize the global economy in the aftermath of the Lehman Brothers collapse, implementing unprecedented monetary and fiscal policies such as quantitative easing and interest rate changes.

3. The actions taken by central banks during the crisis were influenced by a complex interplay of political and economic factors, and the central bankers faced significant challenges in coordinating their efforts with other central banks and governments.

4. The long-term implications of the actions taken by central banks during the crisis are still being debated, and there is ongoing discussion about the need for greater transparency and accountability in the role of central banks in the economy.

5. The book serves as a reminder that the global economy is fragile and that the role of central banks is crucial in maintaining stability and preventing another financial crisis.

"The Alchemists: Three Central Bankers and a World on Fire" is a thought-provoking and informative non-fiction book written by Neil Irwin, a senior economic correspondent for The New York Times. The book takes an in-depth look at the 2008 financial crisis, one of the most devastating economic events of the 21st century, and the role that central banks played in trying to mitigate its impact. The book follows the stories of three central bankers - Ben Bernanke, Jean-Claude Trichet, and Mervyn King - as they navigate the unprecedented challenges posed by the collapse of Lehman Brothers and the subsequent global economic meltdown.

Irwin delves into the decision-making process of these powerful figures and the political and economic factors that influenced their actions. He provides a unique and insightful look into the inner workings of central banks, and the complex and often conflicting pressures they faced as they tried to stabilize the global economy. The book offers a detailed account of the various monetary and fiscal policies that were implemented, including quantitative easing and interest rate changes, and the impact they had on the global economy.

The Alchemists is not only a comprehensive examination of the 2008 financial crisis, but also a sobering reminder of the fragility of the global economy. It is an essential read for anyone interested in economics, finance, and the inner workings of central banks. The book provides a clear and compelling narrative of the events that led to the crisis, the response of the central banks, and the long-term implications of their actions. It is a must-read for anyone who wants to understand the economic forces that shape our world today.

Irwin delves into the decision-making process of these powerful figures and the political and economic factors that influenced their actions. He provides a unique and insightful look into the inner workings of central banks, and the complex and often conflicting pressures they faced as they tried to stabilize the global economy. The book offers a detailed account of the various monetary and fiscal policies that were implemented, including quantitative easing and interest rate changes, and the impact they had on the global economy.

The Alchemists is not only a comprehensive examination of the 2008 financial crisis, but also a sobering reminder of the fragility of the global economy. It is an essential read for anyone interested in economics, finance, and the inner workings of central banks. The book provides a clear and compelling narrative of the events that led to the crisis, the response of the central banks, and the long-term implications of their actions. It is a must-read for anyone who wants to understand the economic forces that shape our world today.