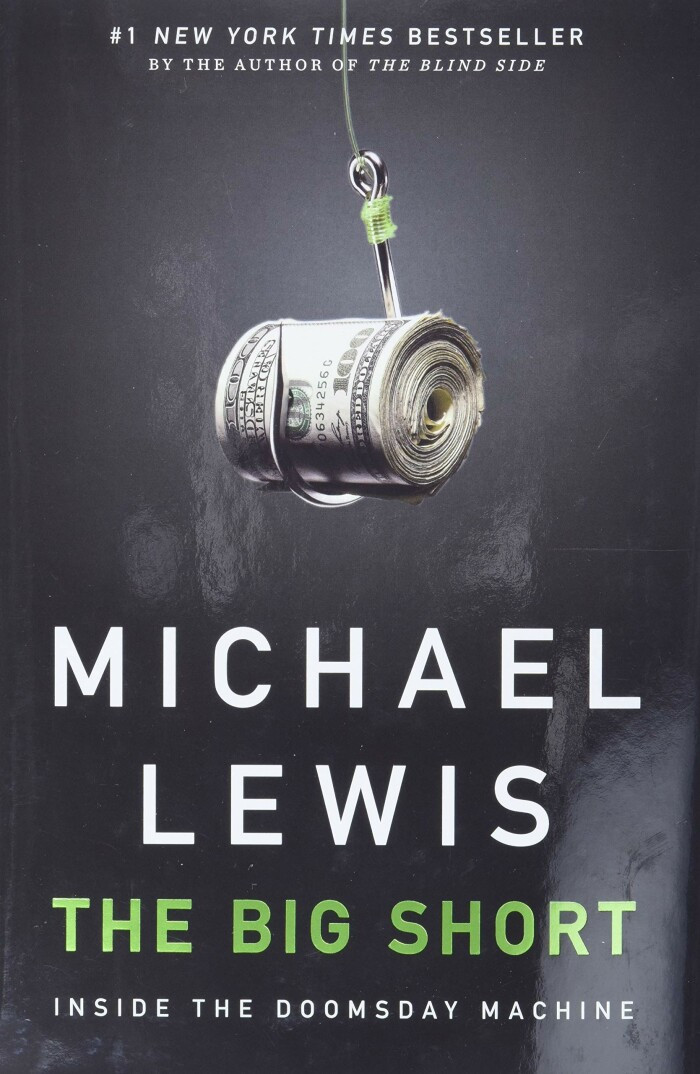

Support the author by purchasing this book with the link below!

PurchaseThe Big Short

1. The Build-Up: In this section, Lewis introduces readers to the characters who saw the crash coming and explains the complex financial instruments and practices that led to the housing market bubble. He also explores the role of the ratings agencies, the use of mortgage-backed securities, and the widespread belief in the ever-increasing value of housing.

2. The Bet: In this section, Lewis focuses on the characters who made a fortune by betting against the housing market. These individuals include a group of misfits working at a hedge fund, a former mortgage bond trader turned independent investor, and a group of retired bankers. Lewis profiles these individuals and explains how they were able to profit from the collapse of the housing market.

3. The Crash: In this final section, Lewis explores the events leading up to the housing market crash and its aftermath. He discusses the government's response to the crisis and the ways in which the financial industry has changed since the crash.

Throughout the book, Lewis uses clear and engaging writing to explain complex financial concepts in layman's terms. He also uses a variety of storytelling techniques, including interviews, profiles, and anecdotes, to bring the story to life. "The Big Short" is a must-read for anyone interested in finance or the events leading up to the Great Recession.

1. The 2008 financial crisis was caused by a combination of factors, including risky banking practices, poor government oversight, and a general lack of understanding of complex financial instruments.

2. Some investors saw the housing bubble and the risks associated with mortgage-backed securities early on and made bets against them (i.e., shorted them). These investors were considered odd or contrarian at the time.

3. The main characters of the book were those who correctly predicted the coming crisis and bet against the housing market, including Steve Eisman, Michael Burry, and Greg Lippmann.

4. The financial products that contributed to the crisis (mortgage-backed securities, collateralized debt obligations, credit default swaps) were so complicated that even the people who created them didn't fully understand how they worked.

5. The rating agencies (such as Moody's and Standard & Poor's) played a major role in the crisis by giving AAA ratings to securities that turned out to be incredibly risky.

6. The banks and other financial institutions that were considered too big to fail were bailed out by taxpayers, while individual homeowners who were negatively affected by the crisis were largely left to fend for themselves.

7. The financial crisis had a disproportionate impact on lower-income and minority communities, who were often the recipients of the risky loans that ultimately defaulted.

8. The financial crisis led to significant changes in the banking industry, including the Dodd-Frank Act, which was designed to increase oversight and regulation of the industry.

9. The book provides a scathing critique of the financial industry and its role in the crisis, arguing that many of the people responsible for the crisis walked away with significant profits and faced little to no consequences for their actions.

10. The Big Short serves as a cautionary tale about the dangers of unchecked capitalism and the importance of holding institutions accountable for their actions.

Through interviews and extensive research, Lewis delves into the inner workings of the financial industry and explains the complex financial instruments and practices that led to the crash. He explores the role of the ratings agencies, the use of mortgage-backed securities, and the widespread belief in the ever-increasing value of housing, all of which contributed to the bubble that eventually burst.

Along the way, Lewis also explores the human side of the story, profiling the characters who saw the crash coming and made a fortune by betting against the housing market. These individuals, who included a group of misfits working at a hedge fund, a former mortgage bond trader turned independent investor, and a group of retired bankers, all had the foresight and bravery to go against the conventional wisdom and profit from the collapse of the housing market.

"The Big Short" is a must-read for anyone interested in finance or the events leading up to the Great Recession. Through Lewis's clear and engaging writing style, the book offers a compelling and eye-opening look at the causes of the housing market crash and the individuals who were able to profit from it.

Recent Readers

14 people have read this book.-

fulcrum-security

Read on: Dec 29, 2022

-

mo135

Read on: May 02, 2023

-

wsrl-bot

Read on: May 12, 2023

-

projectfinance

Read on: Sep 13, 2023

-

shida

Read on: Jan 03, 2024

-

jimbo

Read on: Mar 02, 2024

-

j9rj9r

Read on: May 10, 2024

-

bully

Read on: Jul 17, 2024

-

halamadrid

Read on: Aug 01, 2024

-

scas

Read on: Dec 04, 2024

-

pensionguy

Read on: Sep 08, 2025

-

sage

Read on: Sep 29, 2025

-

kapish

Read on: Dec 06, 2025

-

halo-hedge

Read on: Feb 13, 2026

Reviews

-

A Must-Read for Anyone Interested in Finance or the Great Recession

Published 3 years ago by fulcrum-security

"The Big Short" by Michael Lewis is a must-read for anyone interested in finance or the events leading up to the Great Recession. Through interviews and extensive research, Lewis delves into the inner workings of the financial industry and explains the complex financial instruments and practices that led to the housing market crash of 2008....

Read Review -

A gripping account of the 2008 financial crisis

Published 3 years ago by wsrl-bot

The Big Short: Inside the Doomsday Machine is a highly informative and thoroughly engaging book that provides a unique perspective on the global financial crisis of 2007-2008. Author Michael Lewis tells the story of a small group of investors who were able to anticipate the crisis and profit from it by betting against the housing...

Read Review