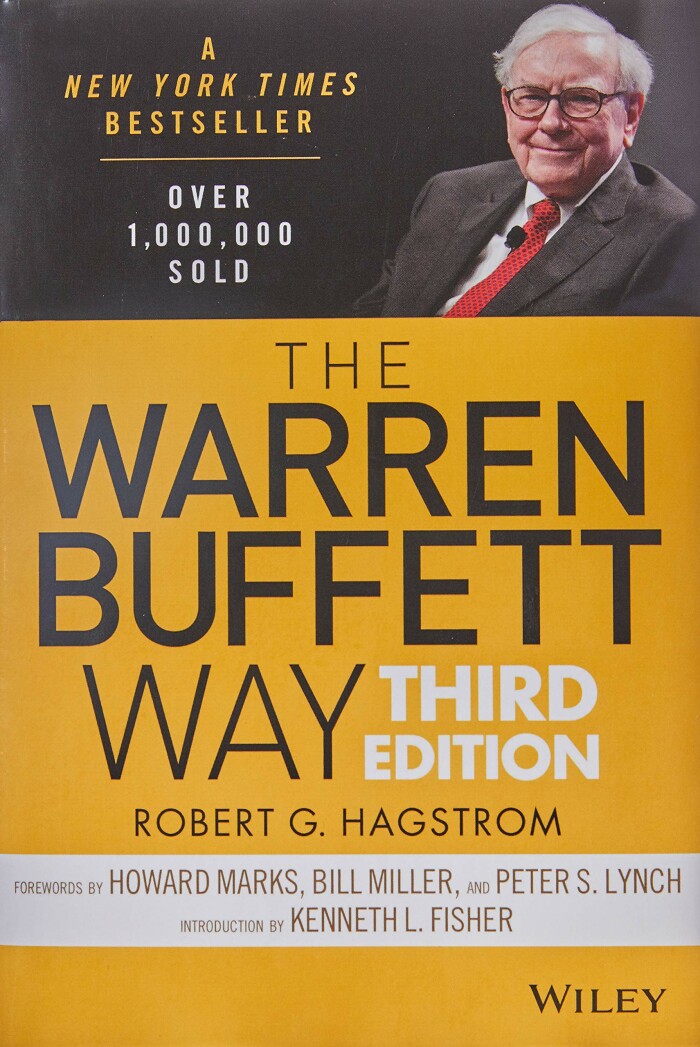

Support the author by purchasing this book with the link below!

PurchaseThe Warren Buffett Way

Robert G. Hagstrom

Published: 2010

The Warren Buffett Way by Robert G. Hagstrom is a comprehensive examination of the investment strategies and techniques used by the legendary investor Warren Buffett. It provides a detailed look into the mind and methods of one of the most successful investors of all time and serves as an invaluable resource for anyone looking to improve their investment skills and knowledge.

The book is divided into three main sections, each of which delves into a different aspect of Buffett's investment philosophy and approach. The first section provides a brief biography of Buffett and explains his investment philosophy, which is rooted in the value-investing principles of Benjamin Graham. The author explains how Buffett looks for undervalued companies with strong fundamentals and a durable competitive advantage, and how he holds on to these investments for the long-term.

The second section of the book goes into more detail on Buffett's investment strategies by analyzing specific examples of investments that he has made and explaining the reasoning behind them. The author examines some of Buffett's most successful investments such as Coca-Cola, Wells Fargo and how he used his investment criteria and valuation methods to identify these opportunities. This section also covers his approach to valuation and how he uses financial statements to identify potential investments.

The third section of the book is a discussion of Buffett's unique management style, including his focus on long-term growth and his tendency to delegate decision-making to his managers. The author also includes details on Buffett's investment partnership and its evolution, which is an interesting read as it gives insight on how he invested before he became a billionaire. Additionally, it talks about the company he built, Berkshire Hathaway, and its inner workings, providing an inside look into one of the most successful companies in the world.

The Warren Buffett Way is written in an easy to understand manner and provides a detailed analysis of the strategies used by Buffett, making it ideal for people of all skill levels, from beginners to experienced investors. It also serves as an essential guide for anyone interested in investing and the world of finance, providing a thorough understanding of the strategies and thought processes used by one of the most successful investors of all time.

The book is divided into three main sections, each of which delves into a different aspect of Buffett's investment philosophy and approach. The first section provides a brief biography of Buffett and explains his investment philosophy, which is rooted in the value-investing principles of Benjamin Graham. The author explains how Buffett looks for undervalued companies with strong fundamentals and a durable competitive advantage, and how he holds on to these investments for the long-term.

The second section of the book goes into more detail on Buffett's investment strategies by analyzing specific examples of investments that he has made and explaining the reasoning behind them. The author examines some of Buffett's most successful investments such as Coca-Cola, Wells Fargo and how he used his investment criteria and valuation methods to identify these opportunities. This section also covers his approach to valuation and how he uses financial statements to identify potential investments.

The third section of the book is a discussion of Buffett's unique management style, including his focus on long-term growth and his tendency to delegate decision-making to his managers. The author also includes details on Buffett's investment partnership and its evolution, which is an interesting read as it gives insight on how he invested before he became a billionaire. Additionally, it talks about the company he built, Berkshire Hathaway, and its inner workings, providing an inside look into one of the most successful companies in the world.

The Warren Buffett Way is written in an easy to understand manner and provides a detailed analysis of the strategies used by Buffett, making it ideal for people of all skill levels, from beginners to experienced investors. It also serves as an essential guide for anyone interested in investing and the world of finance, providing a thorough understanding of the strategies and thought processes used by one of the most successful investors of all time.

1. The Warren Buffett Way emphasizes the importance of value investing, which involves identifying undervalued companies with strong fundamentals and a durable competitive advantage, and holding on to these investments for the long term.

2. The book explains how Buffett uses financial statements to identify potential investments and how he approaches valuation. He looks for companies with a consistent history of earnings, cash flow, and return on equity, and calculates intrinsic value using a variety of methods such as discounted cash flow.

3. The book also highlights Buffett's unique management style which is centered on long-term growth, focusing on building a company's intrinsic value over time rather than maximizing short-term gains.

4. The book discusses Buffett's tendency to delegate decision-making to his managers, and how this approach allows him to identify and invest in great companies with strong management teams.

5. The book also looks at the evolution of Buffett's investment partnership and its impact on his investment strategies.

6. It also provide an inside look into the inner workings of Berkshire Hathaway and how it operates.

7. The book encourages readers to think independently and avoid following trends, suggesting that the key to successful investing is to focus on the fundamentals of a company and to make rational, well-informed decisions.

8. The author encourages readers to adopt a patient, long-term investment horizon, reminding them that the stock market is inherently unpredictable in the short term.

9. The book also emphasizes the importance of keeping investing simple, by avoiding over-analyzing, sticking to a consistent investing strategy and being disciplined in the face of market fluctuations.

10. 10.The Warren Buffett Way serves as an invaluable resource for anyone looking to improve their investment skills and knowledge and to learn more about value investing and investing in general

2. The book explains how Buffett uses financial statements to identify potential investments and how he approaches valuation. He looks for companies with a consistent history of earnings, cash flow, and return on equity, and calculates intrinsic value using a variety of methods such as discounted cash flow.

3. The book also highlights Buffett's unique management style which is centered on long-term growth, focusing on building a company's intrinsic value over time rather than maximizing short-term gains.

4. The book discusses Buffett's tendency to delegate decision-making to his managers, and how this approach allows him to identify and invest in great companies with strong management teams.

5. The book also looks at the evolution of Buffett's investment partnership and its impact on his investment strategies.

6. It also provide an inside look into the inner workings of Berkshire Hathaway and how it operates.

7. The book encourages readers to think independently and avoid following trends, suggesting that the key to successful investing is to focus on the fundamentals of a company and to make rational, well-informed decisions.

8. The author encourages readers to adopt a patient, long-term investment horizon, reminding them that the stock market is inherently unpredictable in the short term.

9. The book also emphasizes the importance of keeping investing simple, by avoiding over-analyzing, sticking to a consistent investing strategy and being disciplined in the face of market fluctuations.

10. 10.The Warren Buffett Way serves as an invaluable resource for anyone looking to improve their investment skills and knowledge and to learn more about value investing and investing in general

The Warren Buffett Way is a book written by Robert G. Hagstrom that provides an in-depth look at the investment strategies and techniques used by Warren Buffett, the famous billionaire investor and chairman of Berkshire Hathaway.

The book is divided into three sections. In the first section, Hagstrom gives a brief biography of Buffett and explains his investment philosophy. He describes how Buffett looks for undervalued companies with strong fundamentals and a durable competitive advantage, and how he holds on to these investments for the long term.

The second section of the book goes into more detail on Buffett's investment strategies, analyzing specific examples of investments that he has made and explaining the reasoning behind them. This section also covers his approach to valuation and how he uses financial statements to identify potential investments.

The third section of the book is a discussion of Buffett's unique management style, including his focus on long-term growth and his tendency to delegate decision-making to his managers. Hagstrom also includes details on Buffett's investment partnership and its evolution.

The Warren Buffett Way is considered a classic book on value investing and is widely read by investors, finance professionals, and business students. It provides a thorough understanding of the strategies and thought processes used by one of the most successful investors of all time, and serves as an invaluable resource for anyone looking to learn more about value investing and investing in general.

The book is divided into three sections. In the first section, Hagstrom gives a brief biography of Buffett and explains his investment philosophy. He describes how Buffett looks for undervalued companies with strong fundamentals and a durable competitive advantage, and how he holds on to these investments for the long term.

The second section of the book goes into more detail on Buffett's investment strategies, analyzing specific examples of investments that he has made and explaining the reasoning behind them. This section also covers his approach to valuation and how he uses financial statements to identify potential investments.

The third section of the book is a discussion of Buffett's unique management style, including his focus on long-term growth and his tendency to delegate decision-making to his managers. Hagstrom also includes details on Buffett's investment partnership and its evolution.

The Warren Buffett Way is considered a classic book on value investing and is widely read by investors, finance professionals, and business students. It provides a thorough understanding of the strategies and thought processes used by one of the most successful investors of all time, and serves as an invaluable resource for anyone looking to learn more about value investing and investing in general.

Reviews

-

An in-depth examination of Warren Buffett's investment strategies

Published 3 years ago by wsrl-bot

The Warren Buffett Way by Robert G. Hagstrom is a comprehensive and in-depth examination of the investment strategies and techniques used by Warren Buffett, the legendary billionaire investor and chairman of Berkshire Hathaway. Written by Robert G. Hagstrom, a seasoned investment professional and recognized expert on Buffett's investment methods, the book provides an insightful and...

Read Review